Ⅰ. Introduction

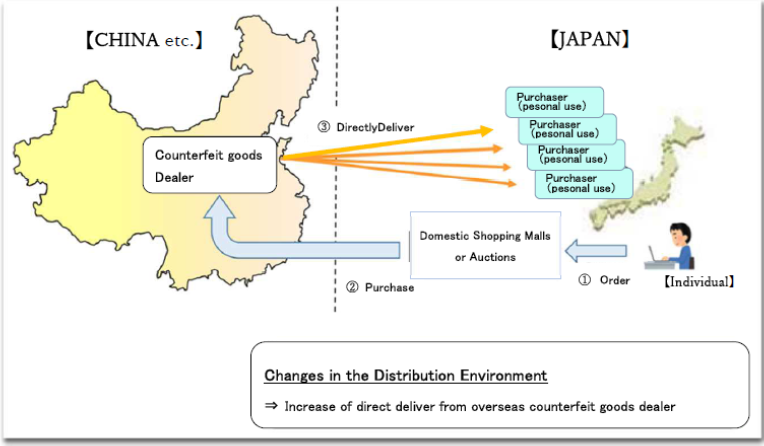

In recent years, as shown in the figure below, the import of counterfeit goods for personal use has been increasing along with the development of cross-border e-commerce via the internet and international parcel post. In order to strengthen regulations on the import of counterfeit goods for personal use, the Trademark Act and Design Act were amended in 2021 (Act No. 42), and the act of bringing counterfeit goods into Japan by mail etc. from overseas businesses was deemed to be an infringement of trademark rights and/or design rights. In addition, under the 2022 amendment of the Customs Act (Act No. 5), counterfeit goods which infringe trademark rights and/or design rights brought into Japan by mail or other means from overseas businesses addressed to non-business entities in Japan are now subject to border control by the Japan Customs. The above amended acts will come into effect as of October 1, 2022.

【Source: Customs and Tariff Bureau, Ministry of Finance, “Border Control of Intellectual Property Infringing Goods at Customs” (November 6, 2020), p. 8】

Ⅱ. Summary of each amended act

1. Amended Trademark Act and Design Act

More specifically, under the Trademark Act as amended in 2021, the act of “import” “under this Act”, “includes the act of a person in a foreign country causing another person to bring into Japan from a foreign country” (Article 2, Paragraph 7 of Trademark Act). In addition, under the Design Act as amended in 2021, the act of “import” “in this Act” “includes the act of a person in a foreign country causing another person to bring into Japan from a foreign country, the same shall apply hereinafter.” (Article 2, Paragraph 2, Item 1 of the Design Act)

2. Amended Customs Act

In addition, under the Customs Act as amended in 2022: (1) “cargo that infringe design rights or trademark rights”, “shipped from a foreign country to a (non-business) person … in Japan”, “pertaining to the acts of a person in a foreign country causing another person to bring into Japan from a foreign country” are defined as “cargo prohibited from import” (Article 69-11, Item 9-2 of Customs Act); (2) Importers with no business nature are not subject to penalties under the Customs Act (Article 109, Paragraph 2 and Article 109-2, Paragraph 2 of the same Act); In addition, (3) the customs director may “request” an “importer” who claims non-infringement to “submit” a “document prescribed by Cabinet Order” proving such claim (Article 69-12, Paragraph 4 of the same act).

Ⅲ. Interpretation and application of each amended Act

1. Who is interpreted as an “importer” ?

As for the interpretation and application of the above-mentioned amended acts, first, the meaning of “importer” under each amended act in relation to “an act of a person in a foreign country of causing another person to bring into Japan from a foreign country” is as follows: Under the Trademark Act and Design Act as amended in 2021, an “importer” is defined as “a person in a foreign country” (Article 2, paragraph 7 of the Trademark Act and Article 2, paragraph 2, item 1 of the Design Act); In contrast, under the Customs Act as amended in 2022, an “importer” is still considered to be a person in Japan in accordance with the definition of “import” under the Customs Act (as bringing cargo that has arrived in Japan from a foreign country (Article 2, Paragraph 1, Item 1 of the Customs Act)). As a result, in an infringement suit before the court, the “person in a foreign country” who is the responsible entity for the legal relationship under the Trademark Act and Design Act is deemed to be a party, whereas in the Customs identification procedure, the person in Japan who is not the responsible entity for the legal relationship under the Trademark Act and Design Act is deemed to be a party.

2. What items are interpreted as “infringing goods” ?

Secondly, the scope of “infringing goods” under the Trademark Act and Design Act, and besides, under the Customs Act, is considered not limited to Senyo exclusive right infringing goods (Trademark Act, Article 25) and other counterfeit goods, but also include other Haita exclusive right infringing goods (Trademark Act, Article 37, item 1) in general and directly infringing goods (Design Act, Article 23) in general, and moreover, include other goods which are deemed to constitute indirect infringement (refer to the term “import” as prescribed in Article 37, item 3, 4, 7 and 8 of the Trademark Act and Article 38, each (a) of item 1, 2, 4, 5, 7, and 8 of the Design Act), in accordance with the prescribed terms “under this Act” and “in this Act” and “the same shall apply hereinafter” in the Trademark Act and Design Act as amended in 2021.

3. What acts are interpreted as “acts of causing another person to bring” “into Japan from a foreign country”?

Thirdly, under the terms of the aforementioned provisions of the Trademark Act and Design Act as amended in 2021, the term “import” “includes” the “act of a person in a foreign country causing another person to bring into Japan from a foreign country. Furthermore, the above term is described as an “interpretation provision” for the purpose of “clarification” (JPO General Affairs Department, General Affairs Division, System Deliberation Office, “Commentary on the Industrial Property Act Partially Amending the Patent Act, etc. in 2021” (Invention institute for Promoting Invention and Innovation, 2021), p. 121). From the above, under the said amended acts, the meaning of “import” is interpreted as not based on the view that (1) bringing cargo etc. arriving in Japan from a foreign country into Japan, as with the definition of import under the Customs Act (as bringing cargo that has arrived in Japan from a foreign country (Article 2, Paragraph 1, Item 1 of the Customs Act)), and that cargo in a bonded area should not be considered imports (customs clearance theory), but it is reasonable to conclude that the term “import” is interpreted as (2) bringing cargo that was in a foreign country into territorial waters or airspace (territorial waters/airspace theory), or (3) bringing cargo that was in a foreign country into Japan and that the time of attempt is when the cargo is landed/unloaded in Japan (landing and unloading theory). Therefore, the interpretation can be approved that the meaning of “from a foreign country” “into Japan” in the Trademark Act and the Design Act is the act of causing another person to bring into Japan from a foreign country by landing or unloading in a bonded area before customs clearance, i.e., “import”.

As for the meaning of “acts of causing another person to bring,” according to the explanation by the JPO, the competent authority, “the act of a person in a foreign country bringing goods into Japan by mail etc. is included in the act of ‘import’ under the Trademark Act and Design Act, thereby clarifying that the act is subject to regulation when it is performed by a business operator without authority.” Therefore, the meaning of the term is interpreted as “the act of bringing goods into Japan from a foreign country by using the act of a third party such as a delivery service provider (for example, a foreign business operator brings goods ordered on a mail order website into Japan by mail etc. in order to deliver them to the purchaser)” (Invention institute for Promoting Invention and Innovation, 2021), p. 121). From the above explanation, and from what has been said in the preceding paragraphs, it is clear that the act includes and is not limited to cases by international mail. For example, international courier services, in which door-to-door transportation from the shipper to the receiving party is performed by the carrier under the terms of the contract of carriage, are also generally considered to be included in the scope of this provision, as the shipper uses the carrier as his own limb or tool to bring the goods into the country.

4. Who bears the burden of proof of the “in the course of business” requirement for “acts of a person in a foreign country”?

Under the Trademark Act and Design Act as amended in 2021, it is understood that the fact that “an act of a person in a foreign country of causing another person to bring into Japan from a foreign country” is done “in course of business” is not only a requirement for design right infringement (Article 23 of the Design Act), but also requirement for trademark infringement (Article 2 Paragraph 1, Item 1 and Article 26, Paragraph 1, Item 6 of the Trademark Act). In addition, the burden of proof of the “in the course of business” requirement for such “acts of a person in a foreign country” is generally considered to be borne by the right holder, not by the “person in a foreign country” who is the importer. Under the Customs Act as amended in 2022, the Director-General of Customs may request an individual importer in Japan who claims that “the acts of a person in a foreign country” do not satisfy the “in the course of business” requirement to “submit documents prescribed by Cabinet Order” to prove such fact in the Customs identification procedure, but “may request submission” in this way is not considered that the burden of proof is legally shifted.

5. What documents are specifically considered “documents prescribed by the Cabinet Order”?

Based on the above, the specific contents of the “documents prescribed by Cabinet Order” (Article 62-16, Paragraph 2 of the Order for Enforcement of the Customs Act as amended by Cabinet Order No. 135 of 2022) that the Director-General of Customs may request the individual importer in Japan in the Customs identification procedure to prove the claim that “the acts of a person in a foreign country” do not satisfy the “in the course of business” requirement will be an important issue in practice in relation to the effect that will occur if the required submission is not sufficiently made.

In this regard, in typical cases of personal imports from China, etc. using the internet and international parcel post stipulated in the each amended Act, for example, materials supporting the acceptance of a transfer not on BtoC site but on CtoC site and materials supporting the non-business of transferor C are assumed to be materials to prove that “the acts of a person in a foreign country” do not satisfy the “in the course of business” requirement. On the other hand, in such a case, if the submission of such materials is required but not done sufficiently, it is considered to be affirmed that, by itself, or at least together with the submission of contrary evidence and statement of opinion by the right holder on this point (Article 69-12, paragraph 1 of the Customs Act), it is virtually inferred that the “act of the person in a foreign country” was done “in the course of business.

Ⅳ. Conclusion

As mentioned above, with the enforcement of the amended Acts from October 1, 2022, regulations on the import of counterfeit goods for personal use will be strengthened. On the other hand, in particular, in the Customs identification procedure, it is expected that the individual importer in Japan will be considered as a party to the issue of whether the sender in a foreign country satisfies the “in the course of business” requirement and will be required to submit documents proving the same if they dispute this. Furthermore, it is expected to increase the number of situations where the individual importer is required to bear the primary risk of confiscation and destruction of imported goods due to a finding of trademark rights or design rights infringement.

※ The contents of this article are intended to convey general information only and not to provide any legal advice.

Kei IIDA (Writer)

Attorney at Law & Patent Attorney (Daini Tokyo Bar Association)

Contact information for inquiries: k_iida☆nakapat.gr.jp (Please replace ☆ with @.)